Artificial intelligence is really changing how people invest their money. AI programs can now help pick stocks and analyze company earnings reports. These tools can spot market trends and find important details hidden in financial numbers. Basically, they give regular investors a new advantage. For example, there are new tools like Reporto, which acts as an AI assistant for looking at earnings reports. You can give it a company’s annual or quarterly report in almost any format. Then, the tool will pull out the most important numbers for you. It looks at things like Net Profit Margin, ROE, and debt levels. Reporto uses its technology to find trends over the last 15 years. It can even write up simple summaries for you. Let’s look at how AI is changing stock picking and how tools like Reporto make sense of earnings reports.

How AI Helps with Stock Picks

So, how does AI help with picking stocks? It works by looking at huge amounts of information all at once. It checks a stock’s past performance, current market trends, and the company’s basic health. Then, it tries to predict which stocks might do better than the overall market. And it seems to work pretty well. For instance, some researchers at Stanford University made an AI analyst. Over a 30-year period, this AI did better than 93% of human fund managers. That’s a huge difference and shows what AI can do. Here are a few examples of stocks that AI models often point to:

- NVIDIA (NVDA): NVIDIA makes the powerful chips that are the brains behind most AI. Since almost everyone needs these chips, the company is in a great spot.

- Arista Networks (ANET): Arista is doing really well because so many companies need its gear for cloud networking. High demand has led to great earnings for them.

- Meta Platforms (META): Meta is jumping into AI-powered advertising. This could become a huge new business for the company, making it a leader in the field.

Making Sense of Earnings Reports

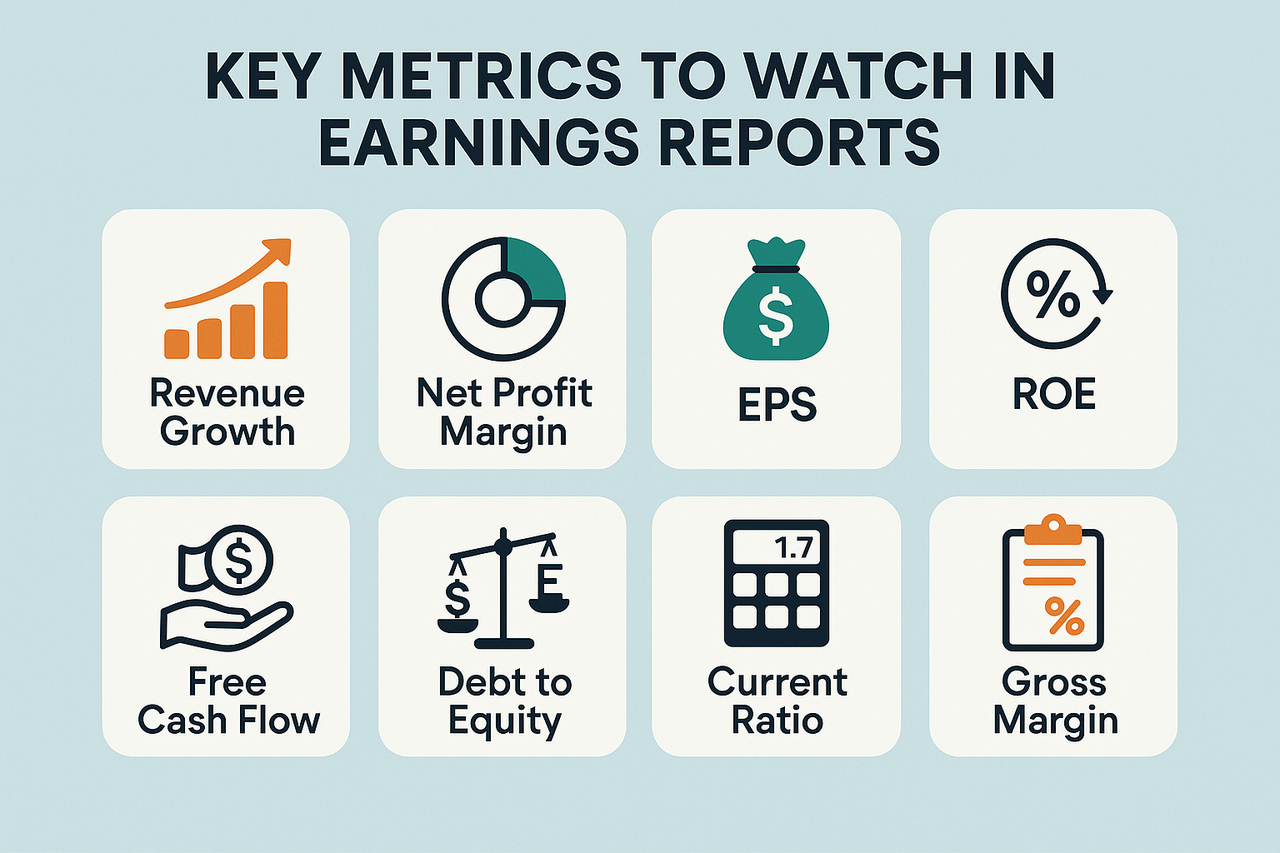

Company earnings reports are very important. They give you a real look at a company’s financial health and what might happen in the future. The problem is that these reports can be long, complicated, and a real headache to read through yourself. This is where a tool like Reporto can be a huge help. It reads the reports for you and pulls out the key numbers instantly. This allows you to use real data to make choices, but much faster. When you look at an earnings report, there are a few key numbers to watch:

- Net Profit Margin: This just tells you how much profit a company makes for every dollar it earns in sales.

- Return on Equity (ROE): This shows how well a company is using its investors’ money to make more money.

- Leverage Ratio: This is about debt. It helps you see if a company has borrowed too much money, which can be risky.

- Asset Turnover: This one shows if a company is using what it owns—its assets—to make sales.

Reporto can also help you dig deeper into a company’s performance, like where its cash is coming from, to give you a full picture.

How a Tool Like Reporto Changes Things

Reporto is basically a smart assistant that gives you useful information. Here is what it can do in the real world:

- Pulls Key Numbers Fast: Reporto instantly finds the most important financial numbers in a report. This can save you hours of work.

- Finds Historical Trends: The tool can look back at 15 years of a company’s data. It often spots long-term trends or patterns that are easy to miss.

- Makes Custom Summaries: You can tell the tool to create short summaries focused only on the information you care about.

- Helps You Share Your Findings: Reporto lets you easily export your findings into PowerPoint slides, Excel sheets, or charts. This makes it simple to show the information to other people.

So, whether you’re looking at one company or trying to compare a few of them, the process becomes much quicker and easier.